©2011-2023 Less Accounting

We’re checking in: How are your finances looking?

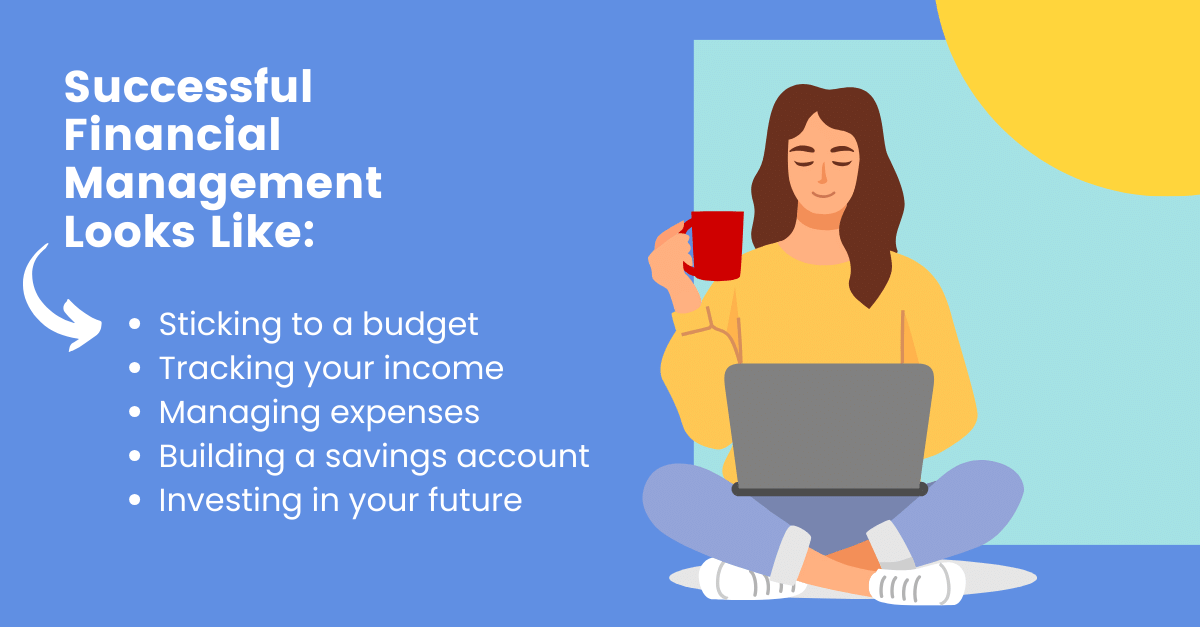

If you’re navigating the exhilarating yet often unpredictable world of freelancing, you know that managing finances is a crucial aspect of your journey. In this blog, we’ll explore tips, tools, and essential tasks to help you achieve better financial management. Whether you’re a seasoned freelancer or just starting out, these insights will guide you on the path to financial success.

Creating a comprehensive budget is the foundation of effective financial management for freelancers, in and out of business. As a freelancer, your income may vary from month to month, making it all the more essential to plan for both personal and business expenses. Allocate funds for taxes, emergencies, and business growth to ensure a stable financial future.

Implementing efficient invoicing systems is crucial for tracking your income. Choose user-friendly invoicing platforms that allow you to send professional invoices promptly. Automated functions like payment reminders and recurring invoices can save you time and frustration tracking down late payments. Additionally, monitor your income streams and identify high-paying clients. This not only helps with financial planning but also highlights opportunities for business expansion.

Categorize and monitor your business expenses to maintain a clear picture of your financial health. Regularly review your expenditures, cutting unnecessary costs and optimizing spending. By being mindful of your budget, you’ll be better equipped to handle the financial ebbs and flows of freelancing.

Having an emergency fund can come in clutch as a freelancer. Set aside a portion of your income to cover unexpected expenses, providing financial security during lean periods. Explore retirement savings options designed for freelancers to ensure a comfortable future beyond your freelancing years. You can still build wealth and plan for your retirement when you are self-employed.

Explore popular accounting tools designed with freelancers in mind. Cloud-based solutions offer accessibility and real-time updates, enabling you to manage your finances efficiently. Simplified accounting software can be a perfect match for small businesses that do not want to get into the weeds with complex accounting tools. These tools streamline tasks like invoicing, expense tracking, and tax preparation, giving you more time to focus on your clients and growing your business.

Invest time in finding user-friendly invoicing platforms that simplify your billing processes. Automation features can save you valuable time, ensuring that your invoicing is accurate and timely. By choosing the right platform, you’ll enhance your professionalism and improve cash flow.

Consider using mobile apps for real-time expense tracking. These apps often integrate seamlessly with accounting software, providing instant updates on your financial status. Stay informed about your spending patterns and make informed decisions to optimize your financial health.

Set aside time each month to review your income and expenses. Adjust your budget and financial goals as needed, taking into account any changes in your freelancing business. This regular check-in helps you stay proactive and responsive to financial shifts.

Stay organized throughout the year to make tax season less daunting. Keep track of business-related expenses, income, and any relevant receipts. By maintaining well-organized books, you’ll cruise through the tax filing process and potentially uncover deductions that can save you money.

Freelancers often face the challenge of determining fair pricing. Regularly assess market rates and adjust your pricing accordingly. Ensure that your income aligns with the value you provide to clients. It’s a dynamic process that requires continuous evaluation to stay competitive and sustain your freelancing career.

Recognize when outsourcing accounting and bookkeeping makes sense for you. If time constraints or the complexity of tax regulations are diverting your focus from core business activities, it might be time to get help from the pros. Outsourcing can free up your time and ensure compliance with financial regulations.

Consider hiring a freelance bookkeeper or accountant who specializes in freelancers’ unique needs. Alternatively, explore services offered by accounting firms experienced in working with solo entrepreneurs. These professionals can provide valuable insights, reduce your stress, and help you navigate the intricate world of freelance finances.

Effective financial management is a cornerstone of freelancing success. By implementing budgeting strategies, leveraging the right tools, completing essential tasks regularly, and knowing when to outsource, you’ll pave the way for a financially stable freelancing career.