Invoicing is a basic principle for all small business owners. How to make an invoice that gets paid faster is key to running a successful business.

It seems simple enough: send an invoice and get paid. But the truth is that invoices can get lost, forgotten, or mislabeled, leaving you with unpaid jobs and cash flow problems. You want to learn how to make an invoice that gets the attention it deserves and gets paid quickly.

To create invoices that convert to cash, follow these simple recommendations to make each invoice a valuable tool for your business.

Writing Tips for Invoices

Use invoicing to keep a detailed record of the products and services that you provide. There’s no such thing as too much information on an invoice because if you are looking for information weeks, months, or even years later, you will wish that you had all that detailed information.

Overwhelmed keeping your business finances organized? We can help!

When:

Your invoices should be sent either right before or directly after services/products are rendered. If you leave too much time between the product/service and billing for it, your invoice might get forgotten. Invoices should also include as much information as possible

Depending on your client agreement and invoicing software, you may be able to set up recurring invoicing that automatically sends invoices at the same time each month. This works really well for retainer clients and ongoing projects. They know when to expect it and you can keep your focus on your work.

You have the power to determine the payment terms for your invoices. You can choose “due upon receipt” or 7, 14, or 30 days later (30 days later is referred to as net 30 in many bookkeeping and invoicing software). Be sure to declare on the invoice when the invoice is due and if there will be any late fees after x-amount of days.

If you struggle with unpaid invoices, read “Collecting Unpaid Invoices the Easy Way.”

What:

When you start invoicing, you need to look at what information is on your invoice. Each piece of information serves the purpose to keep you and your client informed of the work completed and payment terms. It’s even better if it is in an easy-to-replicate format for future invoices. You can use an invoice template or invoicing software to speed up the process.

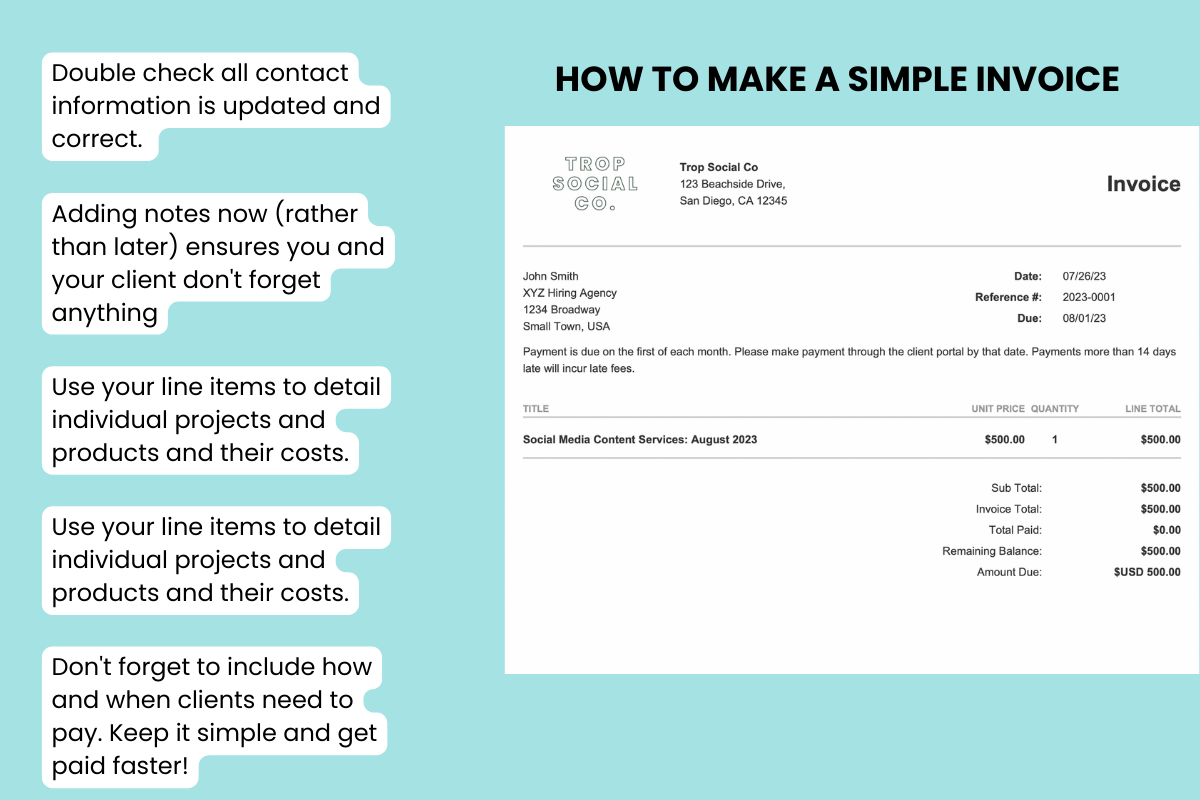

Here is the most important information you need to make a simple invoice:

- Your business name and contact information

- Your client’s business name and contact information

- Date of services/products sold

- Type of services/products with descriptions

- Notes about payment terms, project details, or amendments made to the original project proposal

- Directions for how to pay

- Due date

- Invoice number

The easier you make it for your clients to pay your invoice, the quicker you’ll get paid. Using invoicing software allows you to integrate with your bookkeeping software and payment processors so that clients can pay you in just a couple of clicks.

Common Invoicing Mistakes

These are the most common mistakes made that can slow down your invoicing process.

- The invoice has the wrong information

- No payment due date. Try net 30.

- No payment terms. Try Stripe for client payments.

- Confusing line items. List what you sold the client in detail as line items.

- Simple typos and bad grammar.

- Failure to follow up. If you don’t hear back a week before the due date, follow up with the invoiced customer.

How to Make an Invoice that Gets Paid

These simple invoicing tips can go a long way to improving the cash flow of your business. Once you implement the best invoicing practices, you and your clients can focus on your collaborative relationship and less on money.

Our simplified bookkeeping software at Less Accounting makes invoicing AND bookkeeping straightforward and easy to use for small businesses. You can set up recurring invoicing and business expenses all in one place. Take advantage of our 30-day free trial to help you master bookkeeping and get back to running your business in less time.