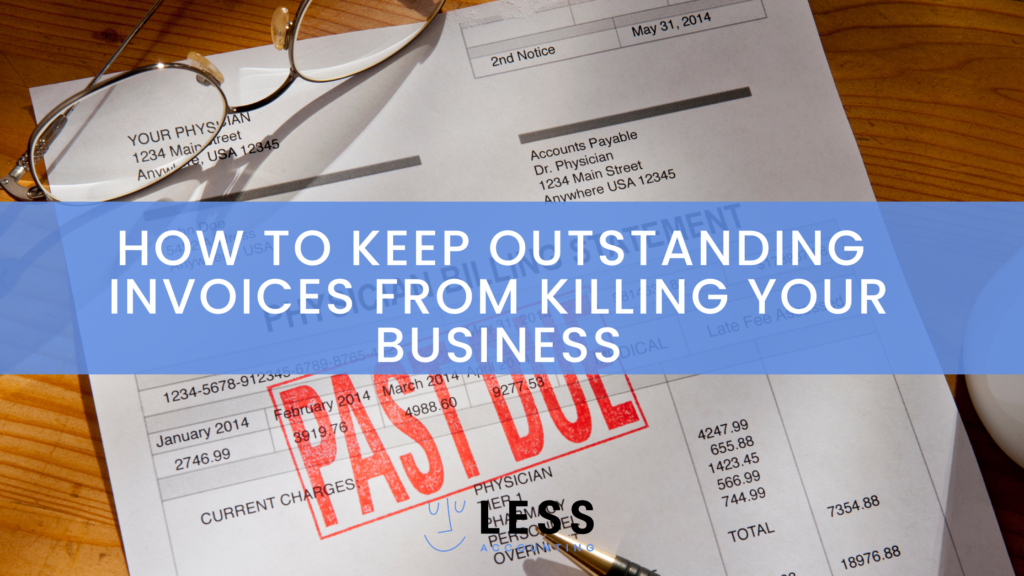

How to Keep Outstanding Invoices from Killing Your Business

In a previous article, I talked about how to deal with unpaid/overdue invoices, but outstanding invoices are not technically late…yet. Outstanding invoices are unpaid but not quite late. As a business owner and guardian of the cash flow, you don’t want these outstanding invoices to become unpaid invoices, so let’s figure out how we can prevent that from happening.

An outstanding invoice is a cash flow issue waiting to happen, especially for freelancers. I’m going to write this article from the perspective of a web/graphic designer or web developer.

Have Less Outstanding Invoices on Your Books

These recommendations can help you manage your invoices with purpose. Clear purpose and direction can help both you and your clients understand the expectations when it comes to invoicing. Let’s dive in.

Shorter Outstanding Invoices, The Money is Due Now

Set your invoice terms to have a shorter due date; I suggest net 0. The longer an invoice sits on the desk of your client the less likely they are to pay you. Outstanding invoices turn into overdue invoices and you don’t become a higher priority by allowing your client to slide by without communication (email or phone). The money is due right now, so use net 0 and get paid faster.

Hourly Workers

As a past consultant, I liked working hourly instead of project-based billing. But the only way I advise you to work hourly is by billing in advance. Get paid before you work, never work before you have the money. Example: You bill now for 40 hours, at hour 20 you bill again for 40 more hours. Jonathan Longnecker of Kicktastic tells “We bill for time spent on projects every two weeks and have language in our contract that says if it’s not paid by the time the next billing cycle comes around we can stop working on it. Though generally, a gentle email reminder is all it takes. :)”

Don’t Release Files until You’ve Received a Final Payment

We’re in a fantastic industry where there’s a hard deliverable that clients pay for–files. This is one of the most essential points, so listen up and repeat after me, “Never release files for a client project until you receive the final payment and the money has cleared.”

Invoice before the Project is Complete

Okay, you’re not releasing files until you get paid, so let’s just invoice the client a week or two before the project will be complete. Be clear to the client why you’re doing this: “I’m sending you an invoice for the final payment or final hours so I can release the files before the deadline and as we’re finishing up.” Keith, founder of KnockKnock Factory says, “We remind our clients of the terms of delivering files post-payment with a friendly email about two weeks before the project is finished. We let them know we’re getting close to launch and we’re sending the final invoice for the remainder of cash for the project.”

Almost Outstanding but Almost Late

So you have outstanding invoices and they are almost late, maybe a week before they’re due. What do you do?

- Resend the invoice with a friendly reminder.

- Call the customer and have a quick chat.

- Re-read this article collecting on overdue invoices.

Side tip: if you’ve sent the invoice and the client is unresponsive, it’s time to come up with a plan. Unresponsive clients are trying to duck paying an invoice.

Remove Some Friction for the Client

Make paying easier and accept payments from PayPal, Stripe, Dwolla, and Zipmark. Of course, send your invoices through LessAccounting like the genius business owner you are.

Client Management

In reality, it’s all about client management, which is about managing clients’ expectations by seeing problems before they happen and predicting their concerns before they have them. Nick Kishfy of Allocate.io says, “It’s important to say upfront that timely payment is important to you for x, y, z reasons. Many companies will respect that if you explain it, especially if they are also a small business.”

Don’t wait until outstanding invoices become late invoices. Switch to a net 0 system, communicate with your clients, and hold deliverable files until you’ve been paid. If you have a plan, you can address outstanding invoices before they become problems.

Invoicing Management Solutions

Having invoicing tools on your side can make a huge difference in how you send and collect invoices. Less Accounting is cloud-based bookkeeping and invoicing software that can help you simplify and streamline how you do business. Try us free for 30 days.